The Best Guide To Dubai Company Expert Services

Table of ContentsGetting My Dubai Company Expert Services To WorkThe Dubai Company Expert Services DiariesThe smart Trick of Dubai Company Expert Services That Nobody is DiscussingLittle Known Facts About Dubai Company Expert Services.Get This Report on Dubai Company Expert Services

Possession for this kind of firm is divided based on supplies, which can be easily bought or marketed. A C-corp can raise capital by marketing shares of stock, making this an usual service entity type for large business. S firms (S-corps) are comparable to C-corps in that the proprietors have restricted personal responsibility; nevertheless, they avoid the issue of dual taxation.A limited firm is one of the most preferred legal frameworks for all kinds and dimensions of services in the UK. This is due to the lots of expert and also financial benefits it supplies, every one of which much exceed those readily available to sole investors or professionals resolving an umbrella firm.

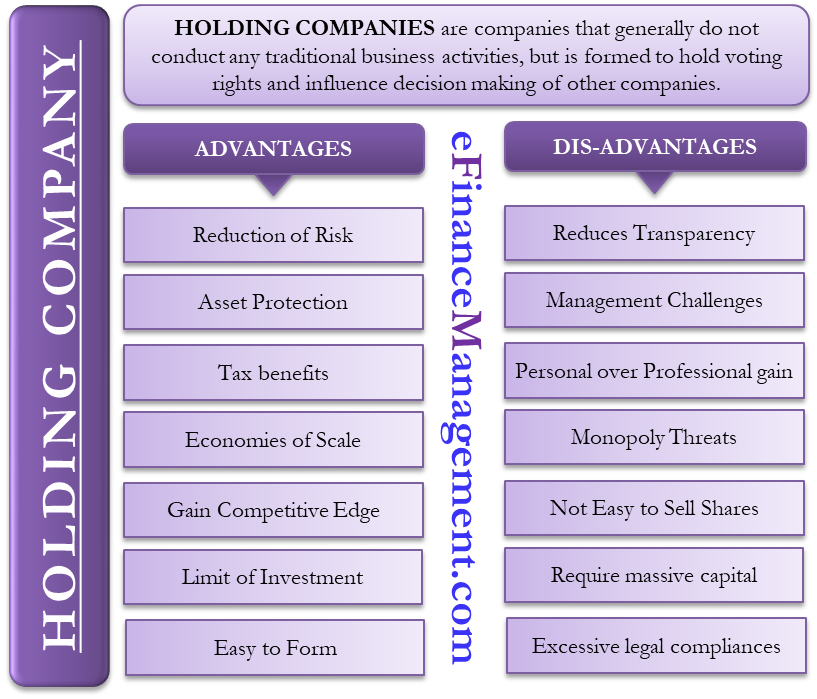

We will certainly additionally outline the prospective disadvantages of company formation when compared to the sole trader structure. The primary reasons for trading as a restricted firm are restricted responsibility, tax effectiveness, as well as professional status. Nevertheless, there are a variety of various other minimal firm advantages readily available. Below, we review every one consequently.

As an investor, you will have no lawful commitment to pay more than the nominal value of the shares you hold. If your business comes to be bankrupt and also is unable to pay its lenders, you will only be needed to contribute the small worth of your unsettled shares. Past that, your personal possessions will certainly be protected.

The Best Strategy To Use For Dubai Company Expert Services

They are directly responsible for any type of as well as all company financial debts, losses, as well as obligations. As a sole investor, there is no separation in between you and also your company.

Whilst the tasks, ownership structure, as well as inner management of your company may be the exact same as when you were operating as a single trader, business are kept in much greater regard and also develop a better impact. The difference in assumption stems greatly from the fact that incorporated organizations are more rigorously monitored.

Reinvesting surplus cash money, Rather than withdrawing all readily available revenues yearly and paying extra personal tax obligation in addition to your Company Tax liability, you can maintain surplus revenue in business to spend for future functional costs and development. This makes even more sense than withdrawing all earnings, paying greater prices of Income Tax, and reinvesting your very own funds when business requires added resources.

Furthermore, the firm will not have any Company Tax liability on the wage due to the fact that earnings are a tax-deductible service cost (Dubai Company Expert Services). See also: You can take the rest of your earnings as returns, which are paid from profits after the deduction of Corporation Tax obligation. You will profit from the annual 1,000 dividend allocation (2023/24 tax year), so you will not pay any individual tax on the very first 1,000 of dividend revenue.

10 Simple Techniques For Dubai Company Expert Services

Nonetheless, reward tax obligation prices are much lower than Earnings Tax obligation rates. Relying on your yearly profits, you might conserve countless pounds in personal tax each year by running as a limited company rather than a single investor. Unlike the single investor structure, a restricted company is a lawful 'individual' in its own right, with a totally separate identity from its proprietors as well as directors.

The main name of your business can not be signed up and also used by any other company. A single investor's business name does not appreciate this protection.

There are some less favourable facets associated with minimal firm formation, as one would get out of anything that supplies a lot of advantages. Many of these regarded negative aspects pale in comparison to the tax obligation benefits, improved expert image, and also restricted responsibility security you will take pleasure in. One of the most remarkable downsides are as complies with: limited firms need to be integrated at Companies Residence you will be called for to pay an unification fee to Firms Residence firm look these up names go through Continue particular limitations you can not set up a limited firm if you are an undischarged insolvent or an invalidated director individual and also corporate details will be disclosed on public document accountancy needs are a lot more complicated and lengthy you might need to select an accountant to assist you with your tax obligation affairs rigorous procedures need to be adhered to when taking out cash from the service a verification declaration and annual accounts need to be submitted at Companies Home annually a Business Income tax return as well as annual accounts must be delivered to HMRC each year.

Nonetheless, there is no legal distinction in between the organization and also the sole trader. This suggests that you would be wholly and personally in charge of all business debts and also responsibilities. Your home and various other assets would certainly go to danger if you were unable to fulfill your financial responsibilities or if legal activity was taken against business.

The Ultimate Guide To Dubai Company Expert Services

The single investor structure is excellent for lots of small company proprietors, particularly freelancers who have just a couple of customers and/or make much less than around 30,000 a year. There may come a time when it is economically or skillfully useful to consider restricted business development. If you get to that factor, your first port of phone call need to be an accounting professional who can advise on the most effective strategy.

A limited business likewise uses several tax obligation benefits; there are numerous benefits to having a prestigious expert picture and status; and also, you can establish a business for non-profit or charitable purposes. The advantages must, nevertheless, be evaluated against the added time as well as money required for the added administration and bookkeeping requirements you will certainly need to handle.

This makes it the excellent framework find out here for lots of freelancers as well as small company proprietors who are simply starting, have extremely couple of clients, and/or generate yearly revenues listed below a specific quantity. To pick the most effective framework for your organization, your decision needs to be based upon your very own personal preferences, along with professional, tailored suggestions from an accountant or consultant that has a clear understanding of your company purposes and lasting plans.

The tax year for Self Assessment runs from 6th April to fifth April the following year (Dubai Company Expert Services). The current tax year began on 6th April 2023 as well as will certainly finish on Fifth April 2024. You can submit your income tax return by blog post or online, as well as you can pay your Income Tax as well as National Insurance policy contributions digitally.

Some Known Incorrect Statements About Dubai Company Expert Services

If you miss the final declaring target date by even more than 3 months, you will receive a 100 penalty. Nonetheless, this penalty may be forgoed if you make an allure to HMRC. If you are late paying some or all of your tax, you might be charged a percent of the exceptional balance.